Responding to the new sales environment and understanding performance expectations are at the forefront of executive’s minds.

Changing buyer behaviour demands new sales and marketing strategies, resource allocations, and tactical approaches, but questions regarding the effectiveness of such changes remain for the new sales environment.

What we do know is, falling cash flow dries up patience, quickly. Changes are now being demanded with little room for trial and error.

In this new sales environment, history is repeating itself just ten years on, and many of the teachings from that previous timeline are more relevant than even then.

In response to the recession in 2009, Sales Focus launched an in-depth study to understand sales performance standards and effectiveness of how the markets were affecting sales management, their capability to respond, the cultures within sales teams, and an organisation’s ability to adapt. The results of the studies documented in the book ‘Building the Most Effective Sales Force in the World: the era post the global financial crisis.’

Pre-recession, for many companies, the sales organisation was operating on market momentum, often with their customer’s growth pulling them along. When the sudden halt of the market occurred with the global financial crisis, vast chasms in the lack of managerial performance came to the forefront.

Sales and marketing management’s ability to respond was hamstrung by the lack of real transparency, insights, and relevant measurements. Companies were responding to subjective information, making the company even more volatile to the markets and exposed to more considerable financial pain as they searched for a new sales environment.

Customer relationships are changing as face-to-face traditional sales are now replaced with video conferencing. Customer problems are not identified as quickly as customer service is also working remotely. The selling environment in B2B sales is making complex sales more difficult as people attempt to build relationships at a distance.

The selling process for your product and services is under pressure as the demand for selling products to deliver sales goals. For many, the traditional sales role is now the biggest challenge to overcome.

The research showed that a minority group or companies, under some 5%, had used the good times to develop best practice standards and were well prepared for seismic market shifts. They were able to make rapid fact-based decisions and guide themselves through the challenging times, minimising the impact.

The book is steeped in case studies and research to assist readers in demonstrating the different models businesses operate in and their response mechanisms. During the investigation, we raised some interesting and fundamental questions to CEOs and sales managers.

A simple yet telling question was, ‘Do you see your sales manager as a business manager or a people manager?’ This directly impacted expectations of the sales organisation and its ability to respond to the markets. It defined the model and tools within the company for the sales organisation to operate.

A key point uncovered in the research interviews is we found that many of the words describing sales management were everyday use in the marketplace but held a distinct difference in the quality of performance and expectation associated with each word. As a simple example, one view of CRM usage was vastly different to another person. This difference directly impacts performance and, in many cases, undermines the company’s ability to grow with a lack of required sales management intel. To the uneducated, it sounded right, but the output was questionable.

A critical piece of work through the study was we identified the six generations of sales management – from low performance to the high achieving sales manager traits and performance, giving a unique guide for hiring and development. That report isolated the need in changing times to either change people or upskill them and what steps you as an organisation need to take.

The study looked deeply into sales and marketing and identified the balance of measurement in top-performing companies. Measuring a series of lagger indicators that provide answers to current results, most common, but importantly the required indicators to ensure reliable predictors for future results being the most uncommon.

Of course, the well-known test of all salesforce performance is their ability to sign new business, and this was explored as the reasons barriers exist in achieving new business during tough and good times.

Companies that responded to the GFC and installed the sales business requirements are somewhat insulated now from the downturn compared to their counterparts who, in the early 2010s, went back to ‘business as usual’ post-crisis.

Sales Performance Levels to date in 2020 through the pandemic

Sales Focus research today is looking at the impact of the pandemic in Australia, and reports are that companies winning business has declined by 38%, and productivity has declined by as much as 42%, with hours cut back to just two or three days a week. Companies with supply contracts are the least affected, whereas others relying on sales appointments are the hardest hit. Notably, pipelines have collapsed, with some reporting no pipeline at all.

Smaller companies with 10-100 employees have experienced the most significant sales declines at 52%.

With this significant decline in sales and productivity, some 33% of sales leaders have taken action to change their go-to-market strategies addressing the new sales environment.

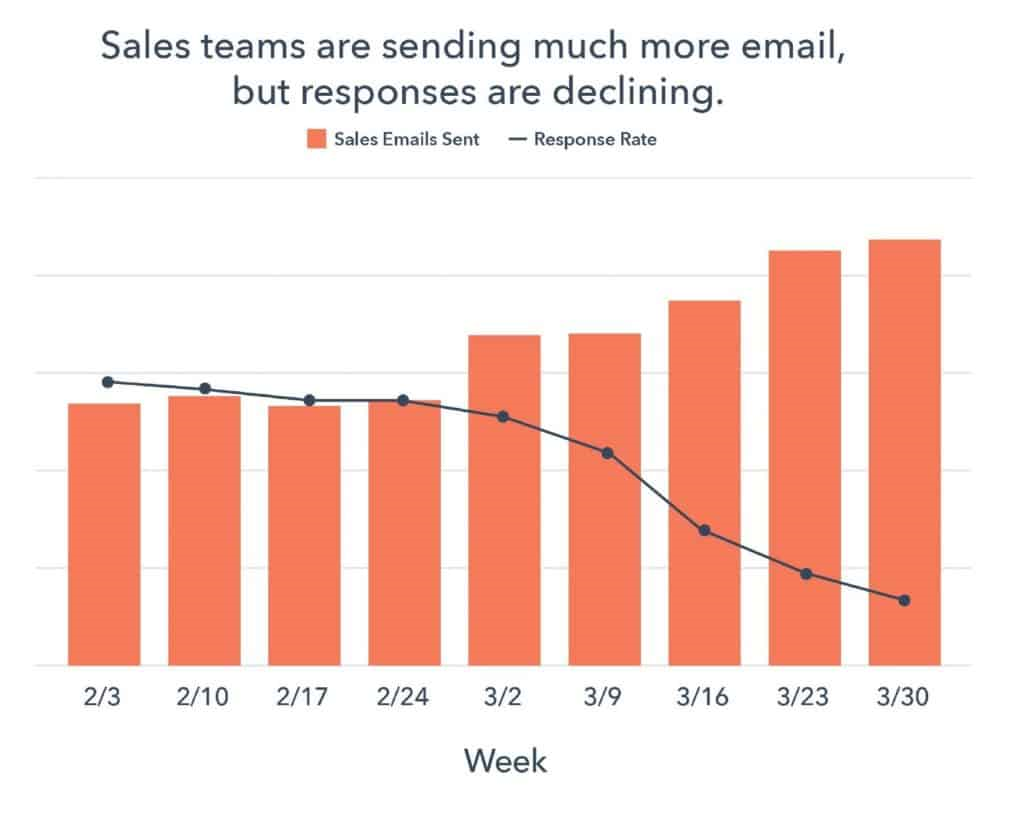

Some influenced by Hubspot’s 2020 COVID-19 USA Sales and Marketing Study, sales teams are now increasing their use of outbound email and social selling strategies, experiencing varying levels of success. HubSpot reports on a per-week basis; companies sent 23% more sales emails during the week of March 16 compared to prior weekly averages in Q1. The response rate to those emails began falling the first week of March, with a total decrease of 27% in March compared to February, as depicted in the HubSpot graphic below.

So what actions do sales leaders need to take to slow or reverse these sales declines in the new sales environment?

There are questions like:

- How do front-line salespeople adjust their selling approaches to connect with prospects and retain key customers?

- How are you keeping up team morale?

- How do you identify the needs of the new sales environment?

You need to take action now

High team morale is the driver of top-line revenue and bottom-line profits. But in times of uncertainty, changing buyer behaviour, and restrained budgets, sales team morale can plummet. Teams need structure and direction to guide them through this crisis, and they look to their leadership to engage with them to solve the problem.

For sales leaders, this requires changing their playbook to accommodate the new selling realities their sales teams face. It requires building a plan that their team believes in, improving their sales strategy, and ensuring that basic management principles are being followed. Establishing measurement that provides valuable insights to support the sales team efforts.

Sales Focus Advisory is drawing on their years of experience through tough markets to work with CEOs and sales managers to develop new playbooks and engage with their teams to provide the tools to overcome the current challenges and shift back to growth.

If you would like to discuss your specific situation and the new sales environment, please reach out to us to organise a telephone conversation.

If you found this article helpful, follow us on LinkedIn or subscribe to Our Insights on the right-hand column of this page to make sure you don’t miss new posts.

Articles you may also be interested in reading:

- Reset, Re-align and Restart your Business

- Actions CEOs Take When Results Fail

- How Accurate Are Your Sales Forecast Reports?

© Y2020 Sales Focus Advisory – All Rights Reserved.